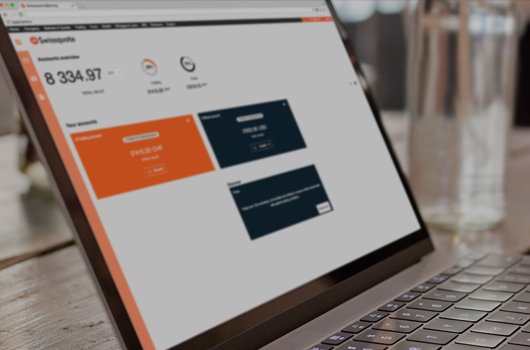

Swissquote continues its rise, despite a year marked by the health crisis in 2020. The Swiss bank recorded an increase in turnover of more than a third and now has over 400,000 customers. Last year alone, the online bank attracted almost 50,000 new customers. The Vaud-based bank had not anticipated such growth, reaching its targets two years ahead of schedule. In addition to opening more online banking accounts, its customers increased their average assets by 8.1%, helping to double its net profit in 2020.

European strategy and cryptocurrencies

Encouraged by this progress, Swissquote has announced a number of ambitious projects. First of all, the bank wants to accelerate its European strategy. This involves increasing the product range and online trading on new stock exchanges. The continental branch of the financial institution, Swissquote Bank Europe, has announced that it is one of the first banks in the eurozone to offer cryptocurrency trading to its customers. Swissquote will offer the possibility to buy and sell bitcoin and ethereum, XRP, litecoin, chainlink, stellar, bitcoin cash, EOS, tezos, 0x, ethereum classic and augur.

Swiss projects

In Switzerland, the canton of Vaud has yet to give its approval for the construction of a 60-metre high building on the bank's site in Gland. This real estate project should raise the number of employees at Swissquote from 500 to 1700. In addition, Swissquote announced the creation of a joint venture with PostFinance. After several years of cooperation on online trading, the two financial giants plan to launch a joint digital banking application in the first half of 2021.

Based on: swissquote.com (.pdf), 20min.ch (fr), paperjam.lu